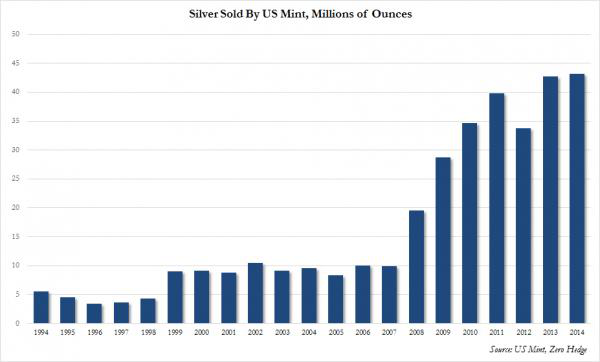

Silver bullion demand remains very robust as silver stackers continue to stack. 2014 has been another record-breaking year at the U.S. Mint which has sold 43.3 million silver eagle coins – up from 42.7 million coins last year.

Record demand in 2014 was seen despite the U.S. Mint running out of Silver Eagles early last month due to very high demand throughout October. As a consequence of this lack of supply, November sales of the coins were down 40.8% according to Reuters.

Silver prices fell 36% last year and, despite obvious shortages in the supply of physical silver, they have declined a further 12.5% this year. This demonstrates the degree to which naked shorting of the market – the selling of paper contracts for gold which the seller is not actually in possession of – is determining price of the physical metal.

Why is it that demand is so high for an investment whose price is falling? For one, silver is a poor man’s gold. Working people with little disposable cash who are nervous about the condition of the global economy can hedge against instability, systemic risk and currency debasement by acquiring a small allocation of silver.

One ounce of silver is currently valued at $16.87. Whereas smaller gold bullion coins such as sovereigns are currently valued at around $283. This makes silver a more attractive and realistic option for a section of people in the western world who have seen their standards of living decimated in recent years.

Clearly, record demand for silver eagles shows a high level of anxiety and indeed fear regarding their financial well-being and that of their families.

Courtesy of GoldCore.